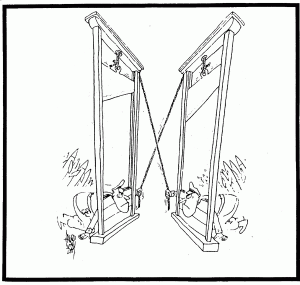

We are often presented with the case of the "natural monopoly." We are told there are certain industries that have extensive barriers to entry, usually in the form of costly infrastructure, meaning high fixed costs. Two examples would be water and telephone companies, water companies having to place pipes in the ground and telephone companies having to erect telephone poles and run wires. They say that to have more than one company in the industry promotes "duplication," ie. two competing water companies will lay out two sets of pipes to reach consumers, two electric companies will each place their own telephone poles and wires, and in each instance we are supposed to be "wasting resources" because we don't need more than one set of telephone poles or water pipes. We are told cities will be riddled with this duplicate infrastructure and so many resources will have gone to waste. Having two (or more) companies compete in these "natural monopoly" industries only creates waste by duplication. This kind of competition is then deemed "destructive," hence the state must establish a monopoly, which we call a "public utility." This notion of "destructive competition" is a corollary to the myth of natural monopoly.

Examining the notion of destructive competition bring up several problems. The fact that we pick and choose between instances of intensive competition and declare one to be favorable while the other is destructive is enough to make one question the existence of this phenomenon known as "destructive competition" in the first place. Why is it that we have companies like Apple competing against Samsung, Barnes and Noble, Google and Amazon with the iPad, Galaxy Tab Nexus, Kindle, and Nexus, yet we don't make the statement that this competition is "destructive?" Let's look at the tablet PC's market and the iPad. Would we have been better off if we banned competition with Apple's iPad, and instituted a monopoly for Apple, because competition would be destructive? A priori we can reason that this claim is absurd.

It can be observed that when companies compete with each other for better products at better prices, they in many instances create their own demand. Looking at the tablet PC market, the demand for the first iPad was very limited (at least much more so that today). Many individuals had doubts about the relevance of tablet PC's; why get a tablet PC which will under-perform a laptop and desktop PC and a few years from now will be an obsolete technology?

Using the logic of destructive competition, we would say that the entry of additional competitors would be destructive with two (or more) companies competing for a limited demand, competing for the same customers. But yet, as more competitors entered the tablet PC market, more demand was created. These companies competed with each other for better products with more features, more computing power, lower prices, etc. and demand exploded.

More competition is not destructive; competition fosters innovation. Creating better and cheaper products allows for more people to be priced into the market, creating demand where there was none prior. In the case of tablet PC's, the better and cheaper products gave more people confidence that the direction of computing was, in fact, heading towards tablets, making it seem like a more reasonable purchase in the eyes of buyers.

The error most people make in calling some competition destructive is that they consider demand to be static; they fail to realize that demand adjusts in response to changes in the market. They only see that the demand for iPads is, let's say, one million customers and the addition of more competitors for that same one million customers is anti-social behavior and must be destined to ruin the market. As we've seen, more competition can in fact stimulate demand so that rather than more competitors vying for the same customers, we have more companies competing for a comparatively greater number of customers.

This is the same flawed argument that has been used to deride technological innovation over and over throughout the years. "If we allow this new piece of machinery, all the laborers who did the work previously will be out of jobs. Their jobs are stolen by machines, the horror!"

But let's look at the facts; did the replacement of the horse and buggy with the automobile destroy jobs, or create countless more? Did the replacement of the farm laborer with machinery destroy jobs and make us worse off? As Henry Hazlitt points out, technology either frees up labor for more productive uses or it stimulates comparatively greater demand, as was the case of the automobile and countless other technologies. Sure people may be unemployed temporarily, but this is a natural condition of the market. It's not something to be derided, it's something to be praised. Are we not grateful that the automobile threw many "poor horse and buggy makers" out of work temporarily so that we all could benefit from the wonders of this new technology? Would we be better off if all farm cultivation had to be done by hand so as to stimulate jobs for agricultural labor? This process of creative destruction is what allows us to integrate newer technologies, allocate labor to its most valuable use, and advance everyone's standards of living.

Also, we cannot expect a company to improve its products or services if they have no one to compete with. A company with no competitors is never going to innovate and they will always defend the status quo. If you are granted a government given right to exclusively serve consumers, why would you want to take entrepreneurial risks if you can retain your customer base regardless of whether they're happy and satisfied or angry and dissatisfied?

We must also realize that even if we take demand as a given, the process we might refer to as "destructive competition" is a process that would simply sort out those who are best from those who are weak. Destructive competition could not continue forever. If there is an overabundance of firms in the market, many (or even all) firms may take a loss in the short run, but in the long run, only the strong will survive. Uncompetitive firms will be weeded out and there will no longer be 'too many' firms anymore. Further, in a market where no firms are making a profit, there aren't going to be any new entrants. Who would enter a market where there is no opportunity to profit? We find that as weaker firms go out of business, there's a magnetic tendency for the market to head towards equilibrium.

To rephrase it, if the market decides there are "too many" firms (characterized by firms taking losses), those who go bankrupt will be cast aside, and those still remaining will find better opportunities for profit with fewer firms. If the market decides there are "too few" firms in the industry (characterized by large profit margins), entrepreneurs will recognize the potential for profit and enter the market. On each side, there is a tendency to sort out the weak from the strong and head towards equilibrium. Only the market is capable of deciding questions like how many firms are too many, through the system of prices and profit and loss. If the market is a natural monopoly, it is immune from the instructions given by the system of profit and loss.

To conclude, the things to take away from this are 1. Destructive competition doesn't exist 2. Even if destructive competition did exist, the profit and loss system ensures that it cannot continue.

(For a specific look at natural monopolies read Dilorenzo's article on The Myth of the Natural Monopoly)

Examining the notion of destructive competition bring up several problems. The fact that we pick and choose between instances of intensive competition and declare one to be favorable while the other is destructive is enough to make one question the existence of this phenomenon known as "destructive competition" in the first place. Why is it that we have companies like Apple competing against Samsung, Barnes and Noble, Google and Amazon with the iPad, Galaxy Tab Nexus, Kindle, and Nexus, yet we don't make the statement that this competition is "destructive?" Let's look at the tablet PC's market and the iPad. Would we have been better off if we banned competition with Apple's iPad, and instituted a monopoly for Apple, because competition would be destructive? A priori we can reason that this claim is absurd.

It can be observed that when companies compete with each other for better products at better prices, they in many instances create their own demand. Looking at the tablet PC market, the demand for the first iPad was very limited (at least much more so that today). Many individuals had doubts about the relevance of tablet PC's; why get a tablet PC which will under-perform a laptop and desktop PC and a few years from now will be an obsolete technology?

Using the logic of destructive competition, we would say that the entry of additional competitors would be destructive with two (or more) companies competing for a limited demand, competing for the same customers. But yet, as more competitors entered the tablet PC market, more demand was created. These companies competed with each other for better products with more features, more computing power, lower prices, etc. and demand exploded.

More competition is not destructive; competition fosters innovation. Creating better and cheaper products allows for more people to be priced into the market, creating demand where there was none prior. In the case of tablet PC's, the better and cheaper products gave more people confidence that the direction of computing was, in fact, heading towards tablets, making it seem like a more reasonable purchase in the eyes of buyers.

The error most people make in calling some competition destructive is that they consider demand to be static; they fail to realize that demand adjusts in response to changes in the market. They only see that the demand for iPads is, let's say, one million customers and the addition of more competitors for that same one million customers is anti-social behavior and must be destined to ruin the market. As we've seen, more competition can in fact stimulate demand so that rather than more competitors vying for the same customers, we have more companies competing for a comparatively greater number of customers.

This is the same flawed argument that has been used to deride technological innovation over and over throughout the years. "If we allow this new piece of machinery, all the laborers who did the work previously will be out of jobs. Their jobs are stolen by machines, the horror!"

But let's look at the facts; did the replacement of the horse and buggy with the automobile destroy jobs, or create countless more? Did the replacement of the farm laborer with machinery destroy jobs and make us worse off? As Henry Hazlitt points out, technology either frees up labor for more productive uses or it stimulates comparatively greater demand, as was the case of the automobile and countless other technologies. Sure people may be unemployed temporarily, but this is a natural condition of the market. It's not something to be derided, it's something to be praised. Are we not grateful that the automobile threw many "poor horse and buggy makers" out of work temporarily so that we all could benefit from the wonders of this new technology? Would we be better off if all farm cultivation had to be done by hand so as to stimulate jobs for agricultural labor? This process of creative destruction is what allows us to integrate newer technologies, allocate labor to its most valuable use, and advance everyone's standards of living.

Also, we cannot expect a company to improve its products or services if they have no one to compete with. A company with no competitors is never going to innovate and they will always defend the status quo. If you are granted a government given right to exclusively serve consumers, why would you want to take entrepreneurial risks if you can retain your customer base regardless of whether they're happy and satisfied or angry and dissatisfied?

We must also realize that even if we take demand as a given, the process we might refer to as "destructive competition" is a process that would simply sort out those who are best from those who are weak. Destructive competition could not continue forever. If there is an overabundance of firms in the market, many (or even all) firms may take a loss in the short run, but in the long run, only the strong will survive. Uncompetitive firms will be weeded out and there will no longer be 'too many' firms anymore. Further, in a market where no firms are making a profit, there aren't going to be any new entrants. Who would enter a market where there is no opportunity to profit? We find that as weaker firms go out of business, there's a magnetic tendency for the market to head towards equilibrium.

To rephrase it, if the market decides there are "too many" firms (characterized by firms taking losses), those who go bankrupt will be cast aside, and those still remaining will find better opportunities for profit with fewer firms. If the market decides there are "too few" firms in the industry (characterized by large profit margins), entrepreneurs will recognize the potential for profit and enter the market. On each side, there is a tendency to sort out the weak from the strong and head towards equilibrium. Only the market is capable of deciding questions like how many firms are too many, through the system of prices and profit and loss. If the market is a natural monopoly, it is immune from the instructions given by the system of profit and loss.

To conclude, the things to take away from this are 1. Destructive competition doesn't exist 2. Even if destructive competition did exist, the profit and loss system ensures that it cannot continue.

(For a specific look at natural monopolies read Dilorenzo's article on The Myth of the Natural Monopoly)